How Traditional Fuels Subsidize the World by Robert Hefner

Subsidies. A mundane yet often published subject, like that of the article published November 14th, 2019 by Forbes titled Fossil Fuel Subsidies And Impact Greenwashing Are Stalling The Energy Transition. It’s an often used, yet thoroughly debunked, attack on those who produce and sell traditional fuels to power our lives. With Forbes alone publishing twice more in the past few months, on July 25, 2019 US Spend Ten Times More on Fossil Fuel Subsidies Than Education and again on October 26, 2019 EU Accused of Subsidizing Fossil Fuels Through Capacity Markets, on the subject of energy subsidies it would seem everyone is discussing subsidies at the coffee shop on a routine basis these days even though that’s quite unlikely. Regardless, it is time to set some things straight.

Many authors writing about energy subsidies, for example, tend to cite a thoroughly debunked study from the International Monetary Fund (IMF) which states the world spent "$5.2 trillion subsidizing fossil fuels in 2017." James Ellsmore is but one of those authors who used this study to suggest

"the $649 billion the US spent on these subsidies in 2015 is more than the country's defense budget and 10 times the federal spending for education."

While it is positive that so many people care enough to write about the mundane issue of subsidies, it prompts me to share the lessons learned over the course of my career in the energy industry.

Subsidies

First, what does it mean? Do you get cash, a check in the mail, a tax write off, or something else? Most are unable to describe what a subsidy is, yet desire the companies that receive them to be found out, shamed, and even forced to shut down. As defined, a subsidy is:

"a sum of money granted by the government to assist a business so that the price of a commodity or service may remain low or competitive."

Billionaire visionary, Elon Musk, felt the subsidians’ wrath after the LA Times reported in May 2015 of his receipt of $4.9 billion in government subsidies. These were actual dollars paid by the United States federal government to Elon Musk companies.

Musk’s response to such criticism was extremely disappointing. Instead of educating his loyal followers about what the subsidies were for or how those subsidies helped Tesla, he simply pointed a finger at the oil and gas industry instead. He responded, “If I cared about subsidies, I would have entered the oil and gas business” while citing that the oil and gas industry was subsidized to the tune of $5.2 trillion. Ironically, and unfortunately, it is the same report being re-circulated this year by Forbes.

What the IMF study defines as a subsidy is not at all a subsidy (and they openly admit it). Not only does this number include corrupt dictatorships, 3rd world countries, and daft futuristic emissions models in their calculations, from page 7 of their report they invent new terms to suggest these numbers - "pre-tax subsidies" and "post-tax subsidies".

“It is helpful to distinguish between the two different notions of fossil fuel subsidies. One is a narrow measure, termed pre-tax subsidies, reflecting the differences between the amount consumers actually pay for fuel use and the corresponding opportunity cost of supplying the fuel. In contrast, a broader measure, termed post-tax subsidies, reflects the differences between actual consumer fuel prices and how much consumers would pay if prices fully reflected supply costs plus the taxes needed to reflect environmental costs and revenue requirements. The post-tax measure therefore corresponds to the definition of subsidies used in this paper, although the international debate (e.g. at the 2009 G20 meeting in Pittsburg) typically focuses on the narrower notion of pre-tax subsidies. Where prices exceed supply costs or efficient prices, then pre-tax and post-tax subsidies respectively are counted here as zero (rather than negative), given our focus on underpricing.”

– Page 7, IMF Report

Almost all of the IMF subsidies are related to the consumption of energy, not the production of energy. So, no, fossil fuel companies do not receive this level of subsidization. The reality of global subsidies for oil and gas is this. Fossil fuel subsidies totaled $548 billion globally in 2013 – not $5.3 trillion as the IMF study indicates. That sounds like a lot of money regardless of which number you use, but in 2013 global GDP was $77.6 trillion. That means that fossil fuel subsidies make up just 0.7 percent of global GDP, despite making up 87 percent of global energy supply.

Thankfully a more seasoned reporter, Tim Worstall (also of Forbes), correctly points this out in his article titled IMF Report on $5.3 Trillion in Energy Subsidies; Careful, It’s Not Quite What You Think. In response to being asked about subsidies, Continental Resources’ Harold Hamm is quick to point out that he has never received a subsidy in his entire career.

“Now my recollection of what a subsidy means is when you are given money to do something. I guess when I drilled 17 dry holes in a row I missed that pay window. No one sent me a check.” – Harold Hamm, Chairman & CEO of Continental Resources

What’s often missed in Mr. Hamm’s statement above is that he risked his own dollars to drill those wells. He didn’t risk a single taxpayer dollar. Are we really upset a man risked his own money to drill dry holes, or profited from that investment? Conversely, the wind and solar industries have actually used and wasted taxpayer money in their investments (e.g. the now spectacularly bankrupt Solyndra which lit on fire $535 million of taxpayer money).

Even the Energy Information Agency (EIA) effectively quashes the IMF’s claim. Mind you, the EIA has chosen to include tax expenditures (which are not actual subsidies) in their definition (shown above). Taking from the EIA’s latest Financial Interventions & Subsidies report, the hard data shows Wind and Solar are HEAVILY ‘subsidized’ in the United States. By comparison Natural Gas & Petroleum Liquids and produce quite a bit of work for the subsidies (including tax breaks) reported in Figure 1.

Figure 1 (Source: EIA, Hefner Energy)

So, in stark contrast to the IMF report, we find quite the opposite to be true. The reality of the situation is that Wind & Solar are heavily subsidized in the United States (while providing very little in exchange in the form of electricity, or work).

What’s even more striking is that even liberals love the laws which “Subsidize” oil and gas. As Robert Rapier writes (in yet another Forbes subsidy article) titled The Surprising Reason That Oil Subsidies Persist: Even The Liberals Love Them,

"The single largest expenditure [oil subsidy] is just over $1 billion for the Strategic Petroleum Reserve, which is designed to protect the U.S. from oil shortages. The second-largest category is just under $1 billion in tax exemptions for farm fuel. The justification for that tax exemption is that fuel taxes pay for roads, and the farm equipment that benefits from the tax exemption is technically not supposed to be using the roads. The third-largest category? $570 million for the Low-Income Home Energy Assistance Program [LIHEAP]. (This program is classified as a petroleum subsidy because it artificially reduces the price of fuel, which helps oil companies sell more of it). Those three programs account for $2.5 billion a year in “oil subsidies.”

In short, the IMF report has been thoroughly debunked and lacks credibility. What they call ‘subsidies’ include imperfect models built upon future projections, 3rd world dictatorships, and absurdly calculated “climate costs” for traditional fuels in their inaccurate definition. Moreover, as more thoroughly described below, the oil and gas industry is subsidized the same way nearly all other industries are (from manufacturing to software). Unless you, the reader, want to hurt farmers and low-income American families, these ‘subsidies’ (which are tax breaks and not dollars paid to oil and gas companies) are not going anywhere anytime soon.

The Amount of Work Done by our Fuels

I recently had the joy of being a guest lecturer at the University of Oklahoma’s Energy Management program (oh for those poor students who had to endure an hour and a half of my lecturing). I shared this same story with those students.

One barrel of oil has the energy content of about 5.8 million British thermal units. A trained athlete can output about 750 Btu per hour of work over a period of several hours. Therefore, one barrel of oil equals 7,733 hours of labor by a trained athlete. At the current average hourly U.S. wage of $25.85 USD per hour, that means a $50 barrel of oil is able to put out $199,898.05 worth of work. In reality, it is cheap energy, not technology, has been the main driver of wealth and productivity in the United States.

A $50 barrel of oil is able to put out $199,898.05 worth of work; equal to 7,733 hours of labor by a trained athlete.

Put differently, $200,000 worth of Tesla batteries (which weigh over 20,000 pounds and comprised of lithium-ion technology invented by an ExxonMobil researcher) are needed to store the energy equivalent of one barrel of oil (which weighs 300 pounds and can be stored in a $20 tank). How much though could Tesla’s Gigafactory, the world’s largest, store? Just THREE MINUTES worth of annual U.S. electricity demand. If you take all the battery capacity worldwide, plus all the batteries in the 1 million electric cars on the road, you could still only store 2 hours worth of national electricity demand.

Did you know that today’s world economies require an annual production of 35 billion barrels of petroleum, plus the energy equivalent of another 30 billion barrels of oil from natural gas, plus the energy equivalent of yet another 28 billion barrels from coal? In visual terms, if all that fuel were in the form of oil, the barrels would form a line from Washington, DC to Los Angeles, and that entire line would increase in height by one Washington Monument EVERY WEEK!? The world, including the United States of America, need a fuel that is able to reliably provide power in a cost-effective, environmentally friendly way. So, what does a $1 million investment into natural gas, wind, and solar look like?

With today’s technology, $1 million worth of utility-scale solar panels will produce about 40 million kilowatt-hours (kWh) over a 30-year operating period. A similar metric is true for wind: $1 million worth of a modern wind turbine produces 55 million kWh over the same 30 years. Meanwhile, $1 million worth of hardware for a shale rig will produce enough natural gas over 30 years to generate over 300 million kWh. That constitutes about 600% more electricity for the same capital spent on primary energy-producing hardware.

Now that we have started to define how different fuels can be, I’d like to call on each of you to eliminate an archaic, draconian term from each of your vocabularies – ‘fossil fuels’.

Did you know that oil is twice as energy-dense as coal, or that natural gas is twice as energy-dense as oil? Why does that matter? Because no society has ever adopted a less energy-dense fuel than its predecessor. Do we really think we are going to buck a trend that has lasted millennia? Did you know anthracite coal has 240 carbon atoms while natural gas is made up of CH4 (one carbon atom, while being 4 times as energy dense as a fuel)? Why then, do we choose to lump them into a single term called ‘fossil fuels’ when they are clearly so vastly different? I applaud Secretary Ming and the Oklahoma First Energy Plan for mostly evaluating each fuel on its own merits and only lumping the fuels together when required as a less partisan term “traditional energy”.

Traditional fuels heavily subsidize our quality of life. I’d challenge each of you to watch Energy Powers Life and ask yourself how many of these products you’re ready to do without? It’s quite comical really. Climate activists complain about ‘fossil fuels’ from their petroleum-based products while wearing their petroleum-based yoga pants while ingesting CO2 directly into their body via their Topo-Chico’s (and shaming you for working in the oil and gas industry because that same CO2 going into their body is so horrible for the environment).

Tax Deductions

Let’s now examine Tax Deductions (which are wholly different than a subsidy whereby a company receives actual dollars). The truth is the oil and gas industry receives the same kinds of tax treatments that every other manufacturing or extractive industry receives in the federal tax code. There is nothing uncommon about this, except for how media outlets choose to portray it.

Percentage Depletion, which has been a feature of the tax code since 1913, is the oil and gas industry’s version of a depreciation deduction for reserves. It is worth about $1 billion a year for U.S. oil companies. Every industry of any kind is allowed this deduction under the U.S. Tax Code. That is, except for integrated oil companies like ExxonMobil, Shell, BP, etc. which were excluded in 1975 from using this portion of the U.S. Tax Code. Today only independent producers (e.g. Continental Resources) and royalty owners (e.g. Hefner Energy) are able to use this depreciation deduction. A repeal of this section of the tax code wouldn’t affect “Big Oil”.

Another is the Manufacturer’s Tax Deduction, more commonly referred to as Section 199. This is the biggest of all the “subsidies”. Section 199, enacted by Congress in 2004 as a means to encourage manufacturers to relocate overseas jobs back to the United States. Ethanol companies use it like crazy, as does Microsoft, Google, BMW, Mercedes and Toshiba, but you don’t hear people calling for Section 199 to be repealed – just repealed for oil and gas companies that enjoy slimmer margins than many of those other industries do. In fact, Congress targeted oil and gas in 2008 and reduced the industry’s deductions under this provision to 2/3rds of what other manufacturing industries are allowed to deduct (again, a tax deduction is not a subsidy).

The tax code does contain oil and gas specific tax deductions – Enhanced Oil Recovery (EOR) Tax Credit and the Marginal Well Tax Credit. Far from being ‘subsidies’ to ‘Big Oil’, these tax credits are used almost exclusively by very small independent producers who tend to become the operators of marginal oil and gas fields (marginal being a well producing 10 barrels per day or less) as they age and are divested by the bigger companies. The EOR credit was implemented in 1990 and the Marginal Well credit was signed into law by President Bill Clinton in 1994. Do we really want to hurt the mom and pops of the world?

Finally, Intangible Drilling Costs (IDCs), which is worth about $780 million per year to the oil and gas industry. IDCs are the equivalent, and use the same part of the tax code, of another industry’s Cost of Goods Sold. Independent producers get to choose either to (a) expense these costs in the year incurred or (b) amortize them over a 5-year period, also known as straight line amortization. Again, “Big Oil” (the ExxonMobil’s of the world) have already been targeted by Congress (1986 and again in 1992) and today are severely limited in their ability to use this portion of the tax code.

As someone described it quite well for the oil and gas industry,

“The elimination of the IDC tax credit would have a huge immediate effect. The IDC is a significant incentive to drill. About 40% of the cost to drill a well is IC (intangible costs). The IDC allows a company to deduct that amount from the taxes owed…not the earned income. So if a company owes the feds $100 million in taxes and spends $100 million in IC it can subtract $35 million (IC X 0.35) from its taxes. Definitely a huge break. So they only pay $65 million in taxes. But take note: the ICD doesn’t increase the company’s revenue or profits: it allows them to spend more money drilling. If they don’t spend it drilling new wells they lose it. That’s the logic behind the IDC tax credit: instead of letting the govt spend the money the oil industry gets to drill more wells. That was once considered a good thing. The effect on drilling activity: the economics of each project is evaluated on its own merits. This evaluation includes utilizing the IDC. Eliminate it and a number of projects become sub-economic and won’t be drilled.”

So, removing these tax credits from the tax code would hurt the oil and gas industry, yes; it would also hurt all industries associated with Manufacturing and Sales. Even President Barack Obama condemned politicians “slogans and gimmicks” on energy policy instead advocating for Natural Gas (as he did in more than one of his State of the Union addresses).

Climate Change

“When you find yourself on the side of the majority, it is time to pause and reflect.”

– Mark Twain

Now, let’s be clear. We are sitting here discussing energy subsidies as an attack on traditional fuels because we are being told Climate Change is going to ruin our lives, kill humanity, and kill the world. In a widely circulated video, someone called on us to literally eat our babies to combat climate change (whether a plant or not). While amusing, it was not too dissimilar from a very real Swedish scientist advocating the world eat dead people to combat climate change. As they tell you, earth is in peril.

How inappropriate to call this planet Earth, when it is clearly an ocean.

– Arthur C. Clark

Thankfully the Economist did the Lord’s work in accurately describing the hysteria surrounding climate in their recently published Climate Issue.

“It is important to understand all the things that climate change is not. It is not the end of the world. Humankind is not poised teetering on the edge of extinction. The planet itself is not in peril.” - The Economist (Climate Issue)

Energiewende: A Lesson on Renewable Subsidies

Renewables are not a new industry, and America is not leading the charge switching to Wind and Solar; that title belongs squarely to Germany.

Post-Fukushima the renewable experiment began in Europe (Germany’s Energiewende programme in 2011) and it has become clear there is a direct correlation to electricity costs per megawatt hour of installed renewable capacity.

Mark P. Mills

In a wonderful piece by award-winning environmentalist (who also has his Ph.D. in Nuclear Physics) Dr. Mike Shellenberger titled The Reason Renewables Can’t Power Modern Civilization is Because They Were Never Meant To. Dr. Shellenberger puts Germany’s Energiewende programme front and center.

It’s gotten so bad in Germany that German electricity costs are now among the highest in the world (tied with Denmark). In effect, this translates to a tax on the poor who are unable to afford it. To complicate matters, Germany has also fallen dramatically short of its emissions targets. After investing $36 billion ANNUALLY since 2011 (now over $200 billion invested via direct subsidies), Germany emits more CO2 annually than it did in 2011.

Der Spiegel cites a recent estimate that it would cost Germany $3.8 trillion USD (7 times the amount it spent from 2000 to 2025) to increase solar and wind three to five-fold by 2050. Of the 7,700 new kilometers of transmission lines needed, only 8% have been built while large-scale electricity storage remains inefficient and expensive.

“The wind power boom is over,” Der Spiegel concludes.

In fact, things have gotten so bad in Germany they have resorted to furiously building new coal-fired generation to handle the shortcomings of their astonishing investments into wind and solar in order to cover the shortfalls in reliable electrical generation. Germany has even resorted to leveling Historic German churches to clear the path for new coal production.

A German church is destroyed to make way for a coal-fired generation plant

Germany’s Federal Court of Auditors is even quite forthright about their failures stating, “The shift to renewables, the federal auditors say, has cost at least 160 billion euros in the last five years. Meanwhile, the expenditures "are in extreme disproportion to the results," Federal Court of Auditors President Kay Scheller said.

The public has also begun resisting new wind projects. Headlines now read “German Wind Energy Stalls amid public resistances and regulatory hurdles”. As you might expect, if this is reality, wind turbine manufacturers could be in trouble. It shouldn’t be a surprise then to read German wind turbine maker Senvion Files for Insolvency.

The same perils now exist for solar. Failure Rates for PV Panels are Climbing is the title of a recent article published in Green Building News.

Back in the United States, Texas (the leader of American wind generation) is spending $36 billion on renewable subsidies. It does not seem America has learned lessons from Germany’s Energiewende programme.

Meanwhile Oklahoma decided to hand out the largest giveaways in the history of their state to the wind lobby. Many don’t know that Oklahoma generates 38% of its electrical generation from Wind (the largest percentage of any state in the country). Wind companies in Oklahoma were able to enjoy the following ‘subsidies’:

1. Zero Emission Tax Credit ($253.8 million as of 2018)

2. Ad Valorem Tax Exemption ($50+ million as of 2018)

3. Investment Tax Credit: a federal tax credit equal to 30% of the tax liability of residential (Section 25D) and commercial and utility (Section 48) investors in solar energy property

4. Manufacturers Sales Tax Exemption (est. $284 million)

5. Production Tax Credit: 3.5 cents per kilo-watt hour (kWh)

6. No Cap on Subsidies

7. Paid on Production vs. Sales

It might even surprise you that not even California chose to offer the above-bolded incentives to the wind lobby, with former Governor of Oklahoma Frank Keating realized the extent of his mistake and issued an apology to the citizens of Oklahoma, stating,

“We made a mistake, potentially a $1 billion mistake. When I was governor, I signed a bill that was supposed to jump-start the wind industry, help the state, and create jobs. It didn’t happen. This is a calamity for taxpayers – corporate welfare of the worst kind. We are on the hook to write blank checks to mostly out-of-state and foreign investors – all funded by you, the taxpayer. It cost us $120 million last year alone; money for schools, teachers, for kids, all gone. I ask that all of us work together to end this now.”

– Former Governor Frank Keating

So Oklahoma is handing out the largest giveaway in actual, direct subsidies than it ever has in its history. Why? What do we actually stand to gain from these overly generous handouts?

Did you know the more energy efficient we become, the MORE energy we use?

Did you know that, because of natural gas, America’s Air Quality is better than it has been in 100 years?

Did you know the higher ordered the form of energy (e.g. electricity), the more waste in the system (typically heat)?

Did you know the thermal conversion and transmission losses getting electricity to end-users requires 3x the raw fuel input into the system (i.e. 2/3rds of the primary energy is lost)?

Did you know a wind/solar grid would require, on average, threefold the capacity of a hydrocarbon grid to adequately provide reliable power to the grid?

These facts should lead us to thoroughly examine why anyone truly interested in solving the issue of climate change does not first consider rapid adoption of nuclear energy and/or natural gas. There is a reason why France is seeking to go back to large-scale nuclear. Those who choose to dismiss nuclear and natural gas as solutions to climate change do nothing more than reveal to the world they are more interested in rhetoric than being part of the solution.

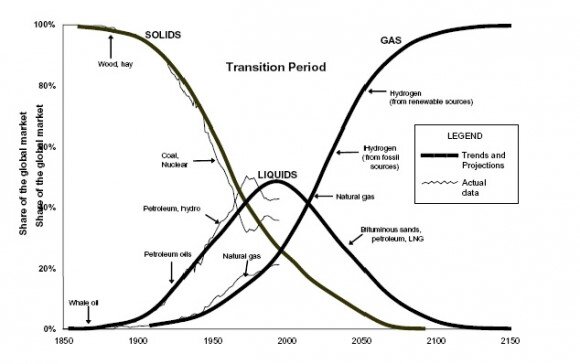

In fact, the Grand Energy Transition is fairly clear. The vast majority of human history was in the age of energy solids. It wasn’t until the industrial Revolution that human-kind began the transition away from solids and towards liquids. Today, we have the opportunity (if we do not squander it) to transition to the age of energy gasses.

Figure 3 - The Grand Energy Transition by Robert Hefner III

While I was not alive at the time of the Arab Oil Embargo and the Fuel Use Act, Congress was forced to deal directly with the issue of energy supplies. Do you recall President Jimmy Carter in his famous televised call to action for Americans to turn their thermostats down while wearing his cardigan? Most do. What most do not recall is that President Carter was the first President to install renewable power at the White House and the first President to address the nation in a televised press conference from the roof of the White House. As history tends to repeat itself, Energy Star is telling us the coolest we should keep our houses is 78 degrees today. President Carter, during that televised event on the roof of the White House President Carter famously declared,”

A generation from now, this solar heater can either be a curiosity, a museum piece, an example of a road not taken, or it can be a small part of one of the greatest and most exciting adventures ever undertaken by the American people – harnessing the power of the sun to enrich our lives as we move away from our crippling dependence on foreign oil.”

– President Jimmy Carter, 1986, from the roof of the White House overlooking 32 newly installed solar panels

President Carter accurately predicted the future; those solar panels are now in a museum, and America has dramatically reduced its dependence on foreign oil because of natural gas (not solar).

I do not think it wise to substitute a dependence on foreign oil for a dependence on Chinese batteries. – the late, great Aubrey McClendon

In the 1970s the major oil companies testified to Congress (in front of then Sec. of Energy James Schlesinger) that natural gas wasn’t a great fuel because of limited reserves. My grandfather, Robert Hefner III, being the only independent operator asked to testify told the committee the exact opposite – that America was ‘awash in natural gas’ estimating trillions of cubic feet in reserves. Secretary Schlesinger laughed at my grandfather then, only to write an apology much later in his life.

"For years, Robert Hefner challenged the conventional wisdom in industry and government regarding natural gas reserves and production potential. His position was treated with skepticism, when it was not dismissed out of hand. Yet, time has proved him right, particularly as shale gas has contributed to a 9% jump in domestic production in just this last year. He was proved right on the Fuel Use Act.“ —James R. Schlesinger, Economist and former U.S. Secretary of Energy, former U.S. Secretary of Defense, and former CIA Director

Remember the second law of thermodynamics? It states that energy can neither be created nor destroyed. The reality is renewables have an energy density problem. No technology, or physicist, will change that.

Why do you believe the United States leads the world in CO2 reductions from 2005-2017 (even while Germany out-invested the United States in installed wind and solar capacity by orders of magnitude)? The answer seems relatively clear once you consider the following graph by EnergyInDepth.

Wind, Solar, and Batteries: I thought they were Environmentally Friendly?

Let’s also be frank about how environmentally friendly wind and solar are in the first place.

It takes 900 tons of material just to build a single wind turbine. “in these wind turbines, there’s up to 800 pounds of copper and 1-2 tons of rare earth metals.”[1] Each wind turbine also includes 538 tons of concrete, 96,000 pounds of reinforcing steel, 8 truckloads to deliver turbine components, 53 concrete trucks of fuel, and a lot of petroleum-based products in their construction as well. That’s not very environmentally friendly at all.

What about solar? Solar panel manufacturing starts with mining quartz, which causes environmental degradation in itself. "The initial refining turns quartz into metallurgical-grade silicon, a substance used mostly to harden steel and other metals," notes IEEE Spectrum, an engineering and applied sciences publication. "That happens in giant furnaces, and keeping them hot takes a lot of energy."

The worst part of it all is batteries. While Lithium is an amazing element (it’s the lightest non-gas element on the chart yet holds extra charge due to its extra electron), harvesting lithium carbonate does a number on the environment. Lithium Carbonate is largely produced from two regions in the world – Australia (the largest producer of lithium, yet the second largest in lithium reserves) and Chile (the second-largest producer of lithium, but the largest in lithium reserves).

Chile takes one environmentally unfriendly approach while Australia takes a completely separate, yet equally environmentally unfriendly approach to sourcing what they refer to as ‘white gold.’

As shown to the right, Chile uses a process of evaporation. The blue pools shown right being lithium carbonate. By the way, to provide perspective, can you see the massive trucks there on the road? This process is causing an unmitigated environmental disaster at the foothills of the Patagonia mountains. The problem is water. The continent’s Lithium Triangle, which covers parts of Argentina, Bolivia and Chile, holds more than half the world’s supply of the metal beneath its otherworldly salt flats. It’s also one of the driest places on earth. That’s a real issue, because to extract lithium, miners start by drilling a hole in the salt flats and pumping salty, mineral-rich brine to the surface. Then they leave it to evaporate for months at a time, first creating a mixture of manganese, potassium, borax and lithium salts which is then filtered and placed into another evaporation pool, and so on. After between 12 and 18 months, the mixture has been filtered enough that lithium carbonate – white gold – can be extracted.

Figure 4 - Separation ponds at SQM Lithium mine, Atacama Desert, Chile. Almost three-quarters of the world’s lithium raw materials come from mines in Australia or briny lakes in Chile.

It’s a relatively cheap and effective process, but it uses a lot of water – approximately 500,000 gallons per tonne of lithium. In Chile’s Salar de Atacama, mining activities consumed 65 per cent of the region’s water. That is having a big impact on local farmers – who grow quinoa and herd llamas – in an area where some communities already have to get water driven in from elsewhere.

There’s also the potential – as occurred in Tibet – for toxic chemicals to leak from the evaporation pools into the water supply. These include chemicals, including hydrochloric acid, which are used in the processing of lithium into a form that can be sold, as well as those waste products that are filtered out of the brine at each stage. In Australia and North America, lithium is mined from rock using more traditional methods, but still requires the use of chemicals in order to extract it in a useful form. Research in Nevada found impacts on fish as far as 150 miles downstream from a lithium processing operation.

Meanwhile Australia uses the same process as many coal producers use to harvest coal – excavation. Personally, it took me quite a while to find the massive excavator truck on the road in the picture to the right. With the way this is being mined, once it collapses, mining is over.

This is important to understand because Australia and Chile/Argentina combine to own 79% of the world’s lithium reserves. It doesn’t help that this process is also linked to horrific working conditions and child labor.

The difference between technology and slavery is that slaves are fully aware they are not free. – Nassim Nicholas Taleb

So, no matter how environmentally friendly a wind turbine or solar panel might be (which they are not) there will always be the environmental issues associated with lithium carbonate mining and the associated “finite source” problem commonly lobbed at traditional fuels. And before you go touting how methane is so much worse than carbon dioxide, read this in-depth thread by Jesse Jenkins on how that thesis has been thoroughly debunked as well.

In Closing

When discussing energy policy many inaccurately refer to subsidies the way the IMF report does (and many are willing to continue citing it even though it’s been debunked). Some do so because they don’t know better (now you do). Some choose do so and know better, which is quite an affront to their readers.

Forward-looking individuals are not asking themselves how they can further subsidize wind and solar. Instead, they are asking themselves how has America reduced its carbon dioxide output to pre-Kyoto Treaty levels?

Do you remember Hollywood’s Michael Moore, the producer of Fahrenheit 451? He has come out with a new documentary – Planet of the Humans – which has come out against renewables as the answer to climate change. In Michael Moore’s film, which has only been screened a few times so far, he reflects:

“It was kind of crushing to discover that the things I believed in weren’t real, first of all, and then to discover not only are the solar panels and wind turbines not going to save us ... but (also) that there is this whole dark side of the corporate money ... It dawned on me that these technologies were just another profit center.”

“We all want to feel good about something like the electric car, but in the back of your head somewhere you’ve thought, ’Yeah, but where is the electricity coming from? And it’s like, ‘I don’t want to think about that, I’m glad we have electric cars,’” Moore said. “I’ve passed by the windmill farms, and oh it’s so beautiful to see them going, and don’t tell me that we’ve gone too far now and it isn’t going to save us ... Well, my feeling is just hit me with everything. I’m like let’s just deal with it now, all at once.”

“There is nothing you will ever have in your life that is not an extraction from the planet earth. Green Energy is not going to save us; it is going to kill us faster.” – Planet of the Humans Director, Jeff Gibbs

About the Author

Robert Hefner is an Energy entrepreneur who was named to Forbes’ Energy & Industry 30 under 30 list and whose insight and theories have been reported nationally from “The Wall Street Journal” through to “The Oil & Gas Investor.” At his core, he is driven by the adventure of tapping into underutilized assets (energy, people, or otherwise), and the opportunity to share stories and form deep connections with those he partners with. To read more about the author or his company, Hefner Energy, please visit www.hefnerenergy.com

Other Referenced Materials

Planet of the Humans (Michael Moore) www.planetofthehumans.com

https://www.wired.co.uk/article/lithium-batteries-environment-impact

The New Energy Economy by Mark P. Mills (Manhattan Institute, 2019)